Financial Services

Financial Services

Your Bank from Disrupted to Disrupter

Prepare for the disintegration of banking and expand your bank's sales and service channels in the market.

As digital traffic takes center stage in banking, staying ahead is crucial. Specialization is the key to success amidst conflicting factors. DefineX helps banks define their future role and build their next-generation banking strategies.

Contact Us

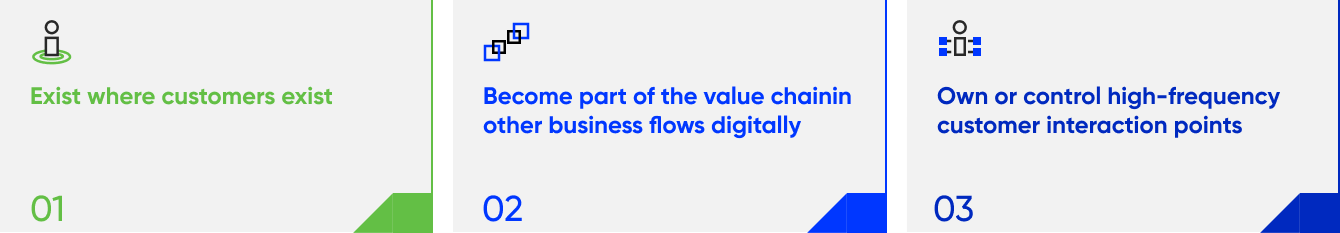

Be the Master of Customer

Holding on to your customers and acquiring more so you can still have the upper hand as the Master of Customer is crucial. When the time comes, your competition will be Telcos, E-Com players and others, and they all have a more extensive customer base than banks today.

How we can help?

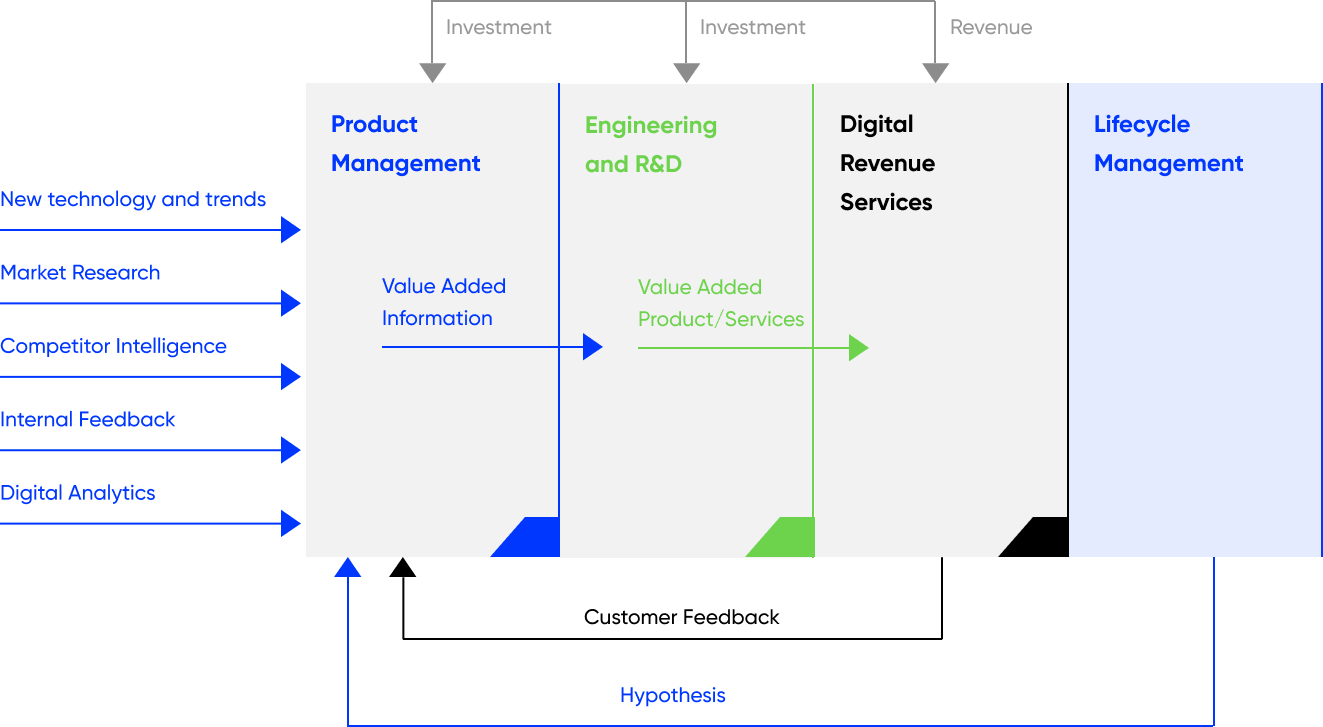

We will follow a proven product methodology for designing and implementing your next-generation services.

Operate as a Digital Platform.

Four successive steps need to be taken by banks considering a next-generation banking play. A robust Digital Platform is the key enabler of this journey at every step.